The Buzz on Tax Services

Table of ContentsTax Services for BeginnersNot known Factual Statements About Tax Services The Greatest Guide To Tax ServicesHow Tax Services can Save You Time, Stress, and Money.Tax Services Can Be Fun For Anyone

It computes your complete gross income, identifying exactly how much you require to pay or just how much the federal government owes you in reimbursements. A 1099 miscellaneous kind consists of various settlements or self-employment earnings for independent contractors. Tax Services. It consists of payments for rental fee, prizes, fishing watercraft earnings, medical and wellness care payments, settlements to an attorney and various other various settlementsIt's best to seek advice from with a specialist to identify whether or not this is a great concept for you. If you require to request a time expansion for filing your government income tax obligation return, you'll make use of the tax extension type. The federal government might likewise hold off the declaring target date when it comes to a nationwide recession.

The Internal revenue service still bills interest, also if you certify for an extension. You might also owe charges if you can not verify your inability to pay on schedule. Employers submit I-9 forms, which confirm staff member identity. Every USA employer is accountable for an I-9 kind for each worker, both people and non-citizens.

About Tax Services

All these forms and information supply great deals of info. Interpreting the info can be challenging for any individual that is not a professional tax obligation accountant. The great print might be concealing credit ratings, reductions or other tax obligation benefits you've missed out on. Even if you really feel well-versed in tax-related language, it could profit you to confer with an expert tax obligation service.

This can be a significant advantage for you and your family members. If you require assist with back taxes or have various other issues, a tax consultant can help reduce the worry on your shoulders. They can work to reduce the collection procedure, minimize the fines you've accumulated and develop an inexpensive repayment plan.

An expert can additionally assist you carry out the finest tax obligation plan for you, your organization or your household. They'll recognize which tax benefits you're eligible for.

If you're ready to maximize your revenues and decrease tax obligation obligation, consider BC Tax obligation (Tax Services). At BC Tax, we provide tax relief, tax obligation planning, account defense and bookkeeping solutions.

How Tax Services can Save You Time, Stress, and Money.

A resources gain describes offering something for even more than you spent on it, such as supplies. The federal government fees you for this revenue with a capital gains tax. There are numerous strategies you can use to minimize your tax concern on your investments. Consider reviewing these alternatives with your tax obligation and financial professionals to establish which might be ideal for your scenario: Spread a sale over 2 years.

By capitalizing on reductions and credits, tax obligation planning solutions make certain that you pay the lowest amount of taxes enabled by legislation. This can lead to significant savings gradually, specifically for local business owner that might have a large range of expenses and revenue streams to think about. Decreasing your tax obligation, click tax planning services likewise help you prevent fines and interest from the IRS.

Tax Services for Beginners

Tax obligation planning is not a one-size-fits-all service; there are different kinds of tax obligation planning customized to various economic situations. Each type offers a particular function and assists deal with the distinct demands of individuals or organizations. This type of tax obligation preparation is targeted at people or family members. It concentrates on enhancing your personal revenue tax obligations by utilizing reductions such as home mortgage passion, clinical expenses, and philanthropic contributions.

It can likewise assist you prepare for growth, mergers, or various other modifications that could impact your tax obligation responsibility. Retirement is a considerable life event, and preparing for the tax obligation implications of retired life revenue is essential. Retired life tax planning focuses on reducing taxes on retired life savings and earnings. This might consist of methods for optimizing payments to tax-deferred accounts, such as 401(k)s or Individual retirement accounts, and lessening tax obligations when you start taking out from these accounts.

Among the most considerable benefits is the capacity to boost your overall monetary savings. By determining deductions and credits that you may not have know, a tax professional can aid you lower the quantity of taxable revenue, leading to much less tax owed. You could certify for tax obligation debts for home improvements, energy-efficient home browse around this site appliances, or education-related costs.

How Tax Services can Save You Time, Stress, and Money.

We provide comprehensive tax obligation preparation solutions tailored to every client's specific demands. Whether you are an individual looking for to lower your personal taxes or a company owner wanting to optimize your operations for tax effectiveness, we have the proficiency and experience to assist. With over 23 years in the market, we check my reference aided over 15,000 customers and prepared over 20,000 tax obligation returns, making us among one of the most trusted tax preparation companies.

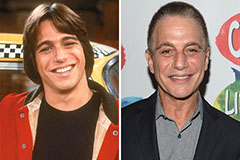

Tony Danza Then & Now!

Tony Danza Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!